Information regarding the insurance provider, Your homeowners insurance coverage binder must show the name of the business guaranteeing your house in addition to get in touch with information, like a telephone number as well as e-mail. You'll also require to give a plan number or consumer ID to ensure that it's simple for the lending institution to reference your plan.

If you possess the house as well as you're wed, you and also your spouse will likely be provided as named insureds. low-cost auto insurance. Your home mortgage firm will certainly require that it be detailed on the policy as a loss payee. Adding themselves as a loss payee on your policy means if there are any kind of changes made to the plan or you file a claim, they will certainly be notified.

What type of residential property you're guaranteeing, The insurance coverage binder ought to consist of an area that determines the kind of home being guaranteed. When it comes to home insurance coverage, the binder would certainly include a description of the home as well as the address of the insured residential property. car insurance. The policy efficient day and also expiry date, The insurance binder will require to consist of the plan efficient day and also expiration day, or when insurance coverage on the residence begins and ends.

Binders are legitimate for up to a month, occasionally much longer. The type of insurance plan Your insurance policy binder will additionally specify the classification of plan under which the residential or commercial property is being guaranteed. There will likely be different areas for residential or commercial property, basic liability, car liability, as well as so forth.

Requirement home owners insurance secures your house versus points like weather-related damage, theft, and also vandalism. You'll desire your binder to consist of as much info about which types of threats your home is safeguarded versus. Your policy insurance coverage amounts, Your loan provider will desire proof that the coverage quantity on the house is high enough so that it can be restored from scratch in case of a catastrophe.

car auto low cost risks

car auto low cost risks

Your loan provider will require this proof to guarantee its investment is safeguarded prior to letting you shut on the loan. Your loan provider will commonly require your insurance binder at the very least three days out of the closing day, however it's also possible they'll require it weeks in advance. Be sure to get in touch with your loan provider as well as give yourself time to store, contrast, and make an educated house insurance policy purchase.

How What Is An Insurance Binder For A Car? - Clearsurance can Save You Time, Stress, and Money.

Like an insurance binder, a dec page can be used as evidence of insurance policy. You just get your dec web page as soon as your plan is released. Up until then, you'll need to utilize an insurance policy binder as proof of insurance coverage.

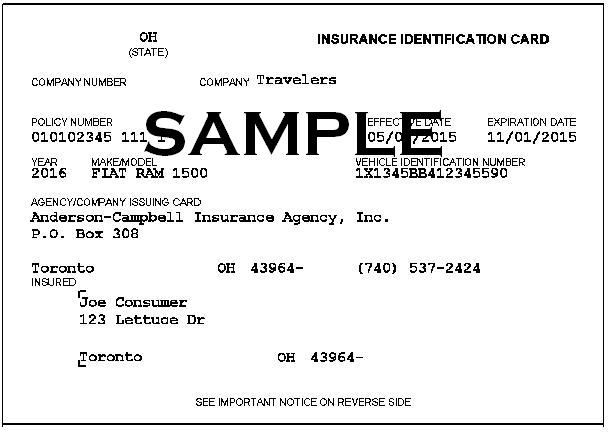

Connecticut law needs that any motor lorry enrollment that has not been canceled must have liability insurance policy. If your registration has actually ended, responsibility insurance policy on the car is required up until the registration/license plates have actually been canceled. Insurer are required to provide you with a vehicle insurance recognition card for each and every lorry.

Call of the insurer, NAIC # A minimum of one name on the enrollment need to be shown as a policy proprietor, plan owner or called guaranteed on the insurance policy card. If a vehicle owned by a leasing firm, the name of the renting business and/or the lessor might be noted. Policy number.

Vehicle year, make or version, and also complete vehicle identification number. A momentary insurance card may be obtained from your insurance agent.: Call of the insurer or firm. A minimum of one name on the enrollment need to be shown as a policy owner, policy holder or called insured on the insurance policy card.

cheap auto insurance dui insurers business insurance

cheap auto insurance dui insurers business insurance

Binder number, plan number or the representative's code number. The kid presents a statement web page from his papa's policy. credit score. An insurance policy recognition card released by an insurance service provider or by a self-insured.

KEEP IN MIND: A computer system generated duplicate of the lorry insurance application signed by the insurance coverage representative serves when the trademark of the insurance coverage representative is an original, in lieu of the carbon copy of a valid binder of insurance policy or application for insurance to the Pennsylvania Assigned Threat Strategy (number 3 and also 4 over) (automobile).

How What Is A Car Insurance Binder? can Save You Time, Stress, and Money.

As soon as an insurance binder expires, it is no more legitimate proof of insurance coverage (trucks). Most of us require to be protected. Home insurance policy is among the numerous safeguards that can help you in case of a crash or catastrophe. Do not allow on your own get captured in a bind allow Hippo supply you with a quote.

While you're looking into auto insurance policy, a common term that might come up is an automobile insurance policy binder - cheaper. What is an auto insurance binder, and do you need one?

What Is A Car Insurance Binder? A car insurance coverage binder is a lawful document provided by your insurance provider that offers temporary evidence of insurance protection. The auto insurance policy binder letter allows you to drive legitimately while the insurance coverage carrier confirms your data and prepares your main automobile insurance coverage file (credit score).

The official policy will usually get here prior to the car insurance policy binder expires, but it never harms to call your insurance provider and ask when you will obtain your official document. As soon as your vehicle insurance policy binder expires, you are not practically covered with vehicle insurance up until your formal plan file and insurance policy card has been issued.

It comes in handy to have an insurance binder handy in situation you are drawn over by the police or have a crash. If you are financing your vehicle, you will certainly require an insurance policy binder to reveal your lender that you have actually gotten the amount of insurance required prior to the lender can approve your loan (vans).

It is a wise idea to ask your auto insurance coverage firm where it will certainly be sending out one to you before it comes. Is A Future Policy Ensured Once I Get My Insurance Coverage Binder? An official policy is not ensured once you receive your insurance coverage binder. When you obtain your insurance coverage binder, your prospective automobile insurer is also taking a look at several points concerning you.

The Ultimate Guide To Motor Vehicle Insurance - Gwinnetttaxcommissioner

It may likewise choose to alter your automobile insurance coverage rate. What Should You Do When Your Insurance Binder Expires? When your vehicle insurance binder reaches its expiry day, you ought to call your automobile insurance provider to make sure that your official policy has been issued. Upon expiration, you shed insurance policy protection, so it is vital to understand that your official plan is on its method before your binder runs out.

Whenever you buy car insurance policy, you need to get quotes from several insurance coverage agencies so you can compare insurance coverage as well as rates. insurance. Along with the insurer you choose, variables such as your age, automobile make and also model, as well as driving history can impact your costs, so what's best for your neighbor may not be best for you.

dui laws cheaper cars vehicle insurance

dui laws cheaper cars vehicle insurance

The insurance firm has an A+ BBB rating as well as an AM Finest economic stamina rating of A++. It possessed over 13 percent of the 2019 auto insurance market share. With those high marks and also a selection of discount rates, Geico is a solid challenger for most drivers. For even more, review our Geico auto insurance coverage review.

insurance company cheaper auto insurance car insurance car insurance

insurance company cheaper auto insurance car insurance car insurance

Companies receive a rating in each of the complying with categories, as well as a total weighted score out of 5. Insurance firms with strong monetary rankings and customer-first business techniques receive the greatest scores in this classification.

An insurance policy binder is a document that serves as short-lived proof of insurance policy protection until a plan can be issued. Your insurance coverage binder will certainly include details like the kind of plan, protection limits, deductible amounts as well as even more (insurance companies). Essentially, it must match the terms you as well as the insurance firm concurred to when you got a policy.

This write-up covers every little thing you require to understand about insurance binders, consisting of: What does an insurance binder include? An insurance coverage binder consists of every one of the necessary information about an insurance plan, like its coverage limitations and also insurance deductible amounts (vehicle). It might not consist of some specific phrasing that will certainly be in your real plan, yet it will certainly offer a summary of the bottom lines.

Not known Details About What Is An Insurance Binder? - Hippo

Terms of insurance The most essential element of your insurance policy binder is that it outlines the regards to your insurance coverage plan (cheap insurance). This makes it clear to any person who requires to recognize that you have protection while you await the main contract from your insurance company. 2. Policy owner Your insurance binder should list the policy owner, or named insured, also.

If a couple buys a house and it is in both of their names, the insurance policy binder must highlight both of them. If you're getting a vehicle insurance plan for a financed vehicle, the lender needs to show up in the file.

4. Residential property Something else an insurance binder consists of is the risk or building the policy will cover (insure). In most cases, this is a car or residence, though there are great deals of various other opportunities, as well, like a motorbike or a boat. 5. Insurance deductible quantity Your insurance policy binder will certainly identify the deductible amount for every kind of insurance coverage you have too.

6. Adjustments or enhancements Modifications or enhancements, likewise called insurance recommendations or motorcyclists, may additionally be stated in your insurance binder. Whether you're purchasing car or property owners insurance coverage, it is essential that both are plainly defined in your insurance binder. 7. Date of coverage An insurance binder ought to make the regard to insurance coverage clear.

It likewise must identify the person that accredited the binder, which need to Learn more here be your insurance agent. There's normally a disclaimer in this component of the message that states the binder is subject to the terms of the plan language, too.

It can take a few days to process the documents and also to complete underwriting. If your representative does not send you a binder, request one. Not only does it function as momentary evidence of insurance policy, however it also offers as verification of your insurance policy plan. Sorts of insurance policy binders You may get an insurance binder for any type of kind of insurance plan.

Excitement About Automobile Insurance Information Guide

This is necessary, as a loan provider will normally request for evidence of insurance policy when you most likely to buy a house. As soon as the underwriting process is underway, your insurance provider will provide you a house owners insurance binder that works as proof of coverage. That file comes to be void after you receive the main homeowners insurance coverage contract.

You can use your insurance binder as proof of insurance policy protection up until your real policy arrives. LLC has made every effort to guarantee that the information on this website is proper, but we can not ensure that it is devoid of mistakes, mistakes, or omissions (suvs). All content and also services given on or through this site are given "as is" as well as "as available" for usage.

com LLC makes no depictions or guarantees of any type of kind, reveal or implied, regarding the operation of this website or to the details, web content, products, or items included on this website. You specifically concur that your use this site is at your single risk.